Imminent Increases in Ocean Freight Predicted

While pandemic-related shipping challenges have tapered, global logistics providers are foreseeing another rise in ocean freight rates due to increased demand, port congestion and capacity issues caused by unprecedented global events including the Red Sea crisis and conflict in the Middle East.

The pandemic caused a sharp over-demand followed subsequently by an over-supply peaked in the third quarter of 2023. Initial predictions of over-supply in 2024 were thwarted by the Red Sea crisis, resulting in two series of increased rates. The first increase occurred after the stoppage of routes across the Red Sea, and the second, more impactful increase, is caused due to both an increased demand year over year and port/container congestion.

|

|

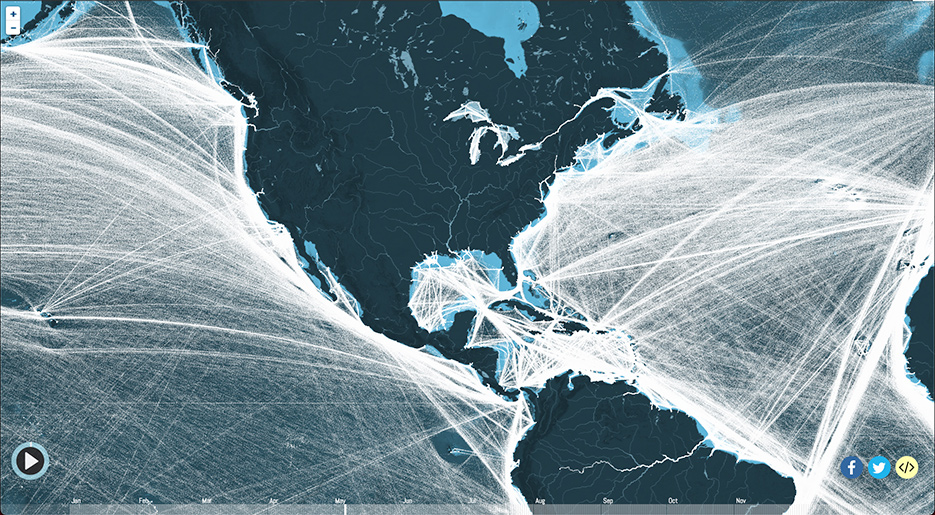

When port hubs become congested, the effects ripple through the supply chain, impacting businesses and consumers worldwide. |

Because the past four years have shown extremes in the supply and demand, fueled by unprecedented global events (COVID-19, Russia/Ukraine War, Israel/Palestine conflict and the Baltimore Bridge collapse, to name a few) the supply chain is experiencing instability. From the lasting impact of the COVID outbreak on consumer purchasing behavior to the Suez Canal blockage, the global shipping industry struggles with port congestion, driver shortages, impending strikes, seasonality shifts, etc. Container availability, particularly in Asia, is limited due to longer transit times and less available container space. Export lanes from Asia to Europe and North America are currently challenged.

“Space and equipment remain tight across many markets, especially those outside of China to US West Coast trades,” Mark Gorman President and CEO of Century Supply Chain Solutions writes. “Particular areas of concern are India and South America. The conflict in the Middle East continues to lengthen transits and reduce capacity and that is not likely to change soon. Further, the possibility of labor unrest on the US East Coast this October adds uncertainty.”

Port congestion has emerged as a critical issue. As key hubs in international trade, ports are crucial nodes where goods are transferred between ships, trucks, and rail systems. When these hubs become congested, the effects ripple through the supply chain, impacting businesses and consumers worldwide. In normal cases, transit times from Dubai to US ports average 40 days. In today’s climate, transit times for the same route take as much as 70 days.

In response to this instability, carriers are swiftly reverting to pandemic shipping behavior, focusing on maximizing asset profitability. Rate increases, emergency surcharges and peak season premiums have been and will continue to be implemented. Capacity restraints due to blank sailings, a scheduled sailing of a container vessel that has been canceled by the carrier, and increased demand in Asia have caused an impact in booking availability out of Brazil, India and Italy.

As an example, freight rates from India to the US have increased by 200%, from Thailand to the US by 375% and from Brazil to the US by 260% since January 2024.

|

|

Global shipping routes indicated by the white lines reveal the intricate network of international trade. |

Consumers can expect an increase in product prices, supply chain disruptions, strategic shifts in sourcing efforts and impact on exporters. Businesses are often unable to absorb the full financial impact of the increased ocean freight, passing along a percentage of the increase to the consumer. Higher shipping costs also lead to significant supply chain disruption, as small to medium-sized enterprises may struggle to absorb these costs, leading to delays or canceled shipments. Additionally, the decrease in booking availability results in extended lead times for exporting products.

Supply chain management and logistics teams can look to mitigate risks, provide quick updates to customers and secure the most current port arrival dates possible. Businesses are reevaluating their supply strategy, levering the nearshoring or reshoring options in addition to booking multiple sailings and alternative routes. Purchasing and supply teams are reviewing inventory and priorities, focusing on tightening demand volumes to secure space for critical and essential products. Monitoring congestion at ports and drayage availability also increases the efficiency of returning empty containers for export.

“It is more important than ever to diversify carriers and forwarders to provide maximum coverage and to have representation that is origin empowered to make decisions in real time,” Gorman suggests. “These critical steps build the agility to mitigate the impact of the disruptions that are likely to continue and might possibly worsen over the coming months.”

The increases in ocean freight costs are a multifaceted issue with far-reaching implications. From pandemic-induced disruptions and container shortages to rising fuel prices and stricter environmental regulations, various factors have converged to create a challenging environment for global shipping. The impacts are felt across the entire supply chain, affecting product prices, availability, and trade dynamics.

Awareness of the global shipping climate allows business owners to prepare for increased cost of goods and operate through extended shipping lead times. By understanding the intricacies of international shipping, businesses can better anticipate potential disruptions and develop more resilient supply chain strategies.