If You Don’t Understand $T, You Don’t Understand How Your Business Makes Money

Rick Phelps

Synchronous Solutions

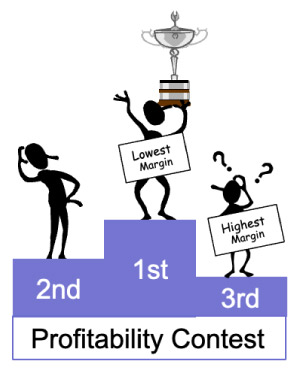

The title of this month’s article comes directly from the end of last month’s article. You might think it a tad arrogant. But the reality is, if you run your business on Margin, you don’t know what you are doing. Now THAT’s arrogant!

Let me give you just the latest example I have encountered. The owners of a fabricating shop give a bonus to their General Manager if the shop’s gross margin for a given month is greater than 60%.

Stop right here. Before proceeding, write down all the reasons this makes perfect sense, and all the reasons why it doesn’t make sense. If you have to think, you will get far more out of this article.

Before I spell out WHY this bonus structure is inane, let’s do a thought experiment.

Suppose it was the last day of the month and you have finished ALL the jobs you had for the month, and it was looking to be a good month. You have nothing to run in the shop, but a couple walks in and wants to buy a couple of vanities made from a slab you have in stock. The catch is, they can only pay what amounts to 40% margin. Feeling in a charitable mood, you take the deal, fabricate the vanities, and the couple takes them with them that day having paid cash.

Did the company make more money or less money this month as the result of this last-minute deal? Obviously more, right?

How much more? They consumed a slab from inventory. All labor was standing around anyway, so no additional expenses there. Therefore, the business’ additional profit was the Cash received minus the Slab Cost. Is the additional profit the Gross Profit/Margin of the sale?

No, the additional net profit is NOT the Gross Profit from the sale, Gross profit would deduct the Direct Labor costs as part of cost of goods sold (C.O.G.S.). But the labor was paid whether or not they produced that additional job. In this simple example, its clear the additional profit is not directly related to Gross Profit/Margin of the additional job. Isn’t that interesting!

No, the additional net profit is NOT the Gross Profit from the sale, Gross profit would deduct the Direct Labor costs as part of cost of goods sold (C.O.G.S.). But the labor was paid whether or not they produced that additional job. In this simple example, its clear the additional profit is not directly related to Gross Profit/Margin of the additional job. Isn’t that interesting!

The additional profit that month is the Throughput Dollars ($T) of the job (Revenue minus Material Cost).

The reality of all businesses is that once the sales from the month bring in enough $T to pay all the Operating Expenses, 100% of the $T falls straight to the bottom line, to the business’ Net Profit.

Gross Margin/Profit has no relationship to the actual profits of the business, and yet most business owners think or act like it does.

Wait, our hypothetical business DID NOT actually sell the couple those vanities and reap those extra profit dollars. You see, the General Manager was carefully monitoring the month’s Gross Profit number, and had he allowed that sale to happen, the Gross Profit of the business would have been 59.9% and NO BONUS CHECK! That would be dumb!

As they used to say on late night television, “But wait, there’s more. Order slabs now for that big job coming up next month and get a big discount!”

That ain’t happening either. Getting those slabs at a discount (or early enough to guarantee the big job goes without a hitch) would put the associated expenses in this month’s C.O.G.S. instead of next, also leading to a loss of bonus. That would also be dumb!

But wait there’s more! That great opportunity you had to finally get in with that big commercial contractor, if only you could have lowered your Margin to 50% on their huge job you got to bid? That didn’t happen, either. That job would have cost your bonus as surely as it would have dumped tens of thousands of dollars to the bottom line. That would be dumb, too!

There are SO MANY ways that doing what is best for the business would be bad for the bonus, and that would be just plain dumb.

The difference between $T and Gross Profit is seemingly trivial. Gross Profit deducts Direct Labor, $T does not. Surely that cannot make that big a difference in how owners and managers make decisions and run their businesses, and yet it does. Here’s why:

When you think in terms of Gross Profit, you think in terms of every job having a profit. The belief of the owner in this story is that high Gross Profit translates into high Net Profit. Seems logical, doesn’t it?

It just ain’t so my friend. Low Gross Profit jobs can be far more profitable for a business than high gross profit jobs. Gross Profit has absolutely ZERO to do with how profitable a job is.

I’ll bet you pay your direct labor the same on days they are killing it as on the days they are coasting by. Therefore, the “Direct Labor” component of C.O.G.S. is NOT directly related to the work in the job, it is related to a lot of other factors having nothing to do with any particular job. The reality is: Direct Labor is a fixed cost in your business. Start treating it that way. That is fallacy #1.

Fallacy #2: The total Direct Labor associated with a particular job is directly related with the capacity of the shop consumed. This, too, is BS. A job with lots of labor content may take very little of what limits the capacity of your shop. It is what limits your shop’s capacity that dictates how much money you will make. If your shop is limited by Routing Capacity, only the Direct Labor associated with Routing has anything to do with profitability. The rest of the Direct Labor deducted to get C.O.G.S. distorts what really matters.

Fallacy #3: Every job contributes to the profits of the business. Nope, more BS. Every job at the beginning of the month just contributes to paying the bills. Every job past break even contributes to Net Profit. This means the faster you bring in money to pay the bills, the faster you hit break even, the more money you make. This would imply profitability must be a RATE. And that is correct.

Revenue gets split into two streams. One stream pays the suppliers for the materials to be consumed in the job, the second stream is the money that stays in the business to pay the bills, then provide profits. The first stream we call Truly Variable Expense, the second stream is called $T. Obsessing over the RATE at which $T flows through the business is what we teach our clients. Because when you understand how $T flows, you understand how your business makes money.

Which brings us to my favorite quote by Mark Twain:

“It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that ain’t so.”

If you got to this point and are thinking “that’s a crock...” reread the above quote, then give us a call at Synchronous Solutions, 216-533-1387!

Rick Phelps has been applying the concepts of Synchronous Flow to difficult industrial problems at dozens of businesses and organizations around the world, since the early 1980s.

In 2009, as Cleveland Cliffs’ Director of Continuous Improvement, Rick took on a failing Lean Six Sigma organization, refocused their improvement work using Synchronous Flow, and created a shop floor, engagement driven, continuous improvement process that Cliffs credits with creating a sustained $100M per year reduction in production costs.