Savings Strategies, Part Two

Sharon Koehler

Artistic Stone Design

In my November 2018 column (Holiday Saving Strategies), I wrote about a couple of apps that could save you some money over the holidays and in the upcoming year. I hope those worked out for you. In this new year, hopefully we have all made our resolutions and are looking forward to doing better in 2019 than we did in 2018.

A common big resolution is to either spend less or save more. The thing is that if you spend less you will in theory have more. Who doesn’t want more money to beef up a savings account, go on vacation, put towards your kids college funds or pay bills? I know I do!

It used to be that stay-at-home moms would babysit for other mothers who worked. Dads would get second jobs. To make more you had to physically go and earn it. Fast-forward to today, and all the spending less / saving more help you could want is at your fingertips.

Recently a big, nationwide chain retail store changed the way its customers could save money by shopping with them. They made it more difficult. I was aggravated by the change because in 2017, I saved enough in their app to by a new TV for my bedroom. So I decided to look for other ways to spend less and save more. I discovered that I had to look no further than my computer or phone. There are so many apps out there that can help you, and you really don’t have to do anything special except sign up.

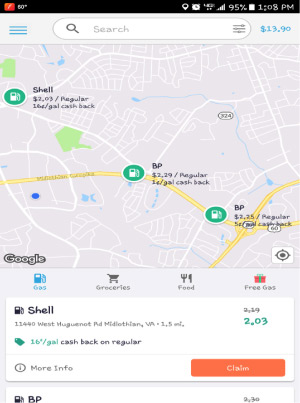

One of the apps I like is Get Upside. It was recommended by a salesman I know who uses it.** Get Upside is a free app that you download to your phone. You can instantly start saving money on gas, groceries and restaurants. I’m in it for the gas savings. They have not yet signed up any grocery stores or restaurants in my area. (The app is very new and a work in progress.)

One of the apps I like is Get Upside. It was recommended by a salesman I know who uses it.** Get Upside is a free app that you download to your phone. You can instantly start saving money on gas, groceries and restaurants. I’m in it for the gas savings. They have not yet signed up any grocery stores or restaurants in my area. (The app is very new and a work in progress.)

It’s simple to use. Open up the app and look for their deals on gas. Claim the deal that is best for you. Go to that station, pay at the pump and then take a picture of your receipt and upload it to the app. That’s it! I have had the app for a bit over a month and as you see by my screenshot, I have already accumulated $13.90. I will probably cash out when it reaches enough for a full tank of gas.

Now, if you’re like me, you might think Shell, Exxon or BP gas is more expensive, so I tried a little test. I usually fill up at a local warehouse club, and it is normally a bit cheaper than regular gas stations. The gas there was posted as four cents cheaper than the app price of $2.19 at Shell, but that still means I am getting a rebate of 12 cents per gallon.

The downside to Get Upside is that they are mainly on the East Coast and very heavy in the Washington DC area. However, they are working a program to expand. Late in 2018 they launched in Texas, so give them time.

Groceries are a big expense. People have tried for years to save money on groceries. Couponing takes a ton of time and unless you are one of those “Extreme Couponers” like you see on TV, you probably spend more than you save in both time and money.

You can start saving on groceries now. There are lots of ways to do it. Most grocery stores these days have delivery either through them or a third party. I signed up with a third party grocery delivery service and I love it. It not only saves time but more importantly it actually saves money, especially if you are an impulse shopper. My grocery bill was $125-$150 every time I went. Why? Because as I walk the aisles I see a “good deal” on something or I see something that isn’t on my list but I want it, so it goes in the cart. The third party delivery service was $99 a year. I use them every two weeks, so that’s about $3.80 per delivery. The thing is, my grocery bills with the service average between $70 and $80 every 2 weeks. Basically, I am saving $90 - $100 a month on trips to the grocery store, plus I don’t have to walk the store and stand in line or go out in the rain or snow. Couple that delivery service with the free IBotta app and you are saving even more.

IBotta is also simple to use. Download the app. Open it up and look for rebates on the groceries you normally buy, at the store you would normally shop. (New rebates and savings are usually posted on Thursdays.) Then just take a picture of your receipt and upload it. IBotta lets you know your savings. You cash out at a $20 minimum. Ta – Da!

There are multiple apps out there to help you save time and money. Check out Swagbucks, Shopkick, Cashback Monitor and CamelCamelCamel (for Amazon), as well.

With a little research you can find all kinds of ways to save money on the things you regularly purchase, and most of the time all you have to do is download an app and snap a picture. It doesn’t get any easier. Granted, you won’t get rich with these things, but every little bit helps. Happy New Year!

Please send your thoughts on this article to Sharon Koehler, Sharon@asdrva.rocks .

** Get Upside was recommended to me by a salesman. Note that because he is a salesman, he is reimbursed by his company for his gas expenses. He claims the deal and snaps a picture of his receipt. He gives the receipts to his boss for reimbursement PLUS he gets rebates from Get Upside. So he gets gas for free and makes money on the rebates. That’s a smart guy.