Don’t Let Taxes Hollow Out Your Business

Put ERM in Place

Randy Sadler

Principal, CIC Services LLC

I was on a hike in the mountains when my children jumped on a log on the side of the trail. It crumbled under their weight, and we realized it had been hollowed out by insects and termites. The log looked solid enough to hold their weight, but clearly wasn’t. That log reminds me of a lot of small and mid-size businesses.

Sometimes, things aren’t as they appear. I’ve worked with pieces of stone that looked solid and absolutely beautiful on the outside, only to find them brittle and porous on the inside. Even tiny air pockets and cracks inside of a piece of stone can remain hidden until it is stressed or cut. Some of them just snap under a light load and can result in tremendous rework.

In the same way, porous or hollowed out businesses are poorly positioned for long-term survival. Excessive taxes can take a heavy toll on the economic viability of a countertop manufacturer. This is particularly true for small and mid-size manufacturers which are often less prepared to manage risk, uncertainty and economic swings caused by external forces. This was clearly the case in the 2008 downturn which shuttered many small and mid-sized businesses in the housing and construction industries, wiping out companies, the jobs they provided and their impact on the local economies and communities where they previously operated. Many were ill prepared and lacked flexibility to respond because their previously successful businesses had been hollowed out by years of taxation that thwarted the build-up of reserves.

Hollowed out businesses are bad for local communities, bad for the labor market and bad for America.

How Can Countertop Manufacturers Avoid Letting Excessive Taxation Hollow Out Their Business?

A business owner can choose to own their own insurance company, known as a captive insurance company (CIC). This captive insurance company forms the chassis of an Enterprise Risk Management (ERM) strategy. ERM is a more mature and more comprehensive approach to risk management.

Specifically, ERM is the discipline by which an organization in any industry assesses, controls, exploits, finances and monitors risks from all sources for the purpose of increasing the organization’s short and long-term value to its stakeholders. Successful ERM programs manage

risk across two dimensions - time and space:

Time: Properly developed ERM programs shift Risk Management focus from short-term

(once-a-year when traditional insurance policies renew) to a long-term program designed

with the organization’s overall goals in mind.

Space: ERM programs increase the Depth of Coverage of an organization, allowing for formal

insurance across three distinct areas of risk; Core, Operational and Strategic.

What Does ERM with a Captive Insurance Company Do?

First, it establishes a more robust risk management approach, placing the manufacturer on better survival footing. Second, it enables the business owner or business to own a profitable second business. This profitable business can build up loss reserves, helping prevent the total business entity from being hollowed out by excessive taxation. A CIC primarily insures the risks faced by the operating company or related companies. The primary reasons that businesses or their owners form CICs are:

- To manage business risk by formally self-insuring certain risks with pre-tax dollars.

- To protect assets from creditors of the operating business and its owners or other risks.

- To realize profits and accumulate wealth inside of a separate business entity.

Why are ERM and Owning a Captive Insurance Company an Effective Solution?

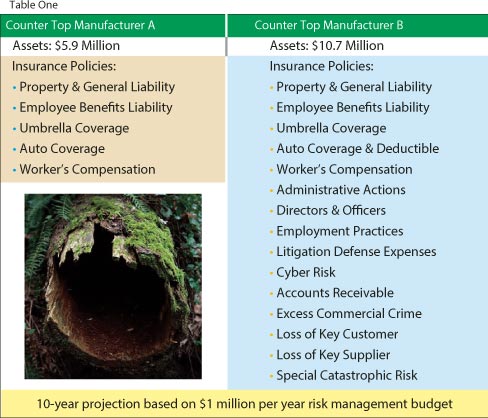

In addition to better positioning a stone countertop manufacturer to better manage risk, ERM can change risk management from a cost center to a profit center. Consider two identical counter top manufacturers as illustrated in Table One. Manufacturer A continues with the status quo. Manufacturer A has $1 million of profit annually and pays taxes of $500,000 per year. At the end of ten years, Manufacturer A has accumulated $5.9 million based on a reasonable investment return. Manufacturer B, however, implements ERM and owns a CIC. In the exact same 10 year period, Manufacturer B has MORE INSURANCE and MORE MONEY (almost twice as much wealth as A).

In addition to better positioning a stone countertop manufacturer to better manage risk, ERM can change risk management from a cost center to a profit center. Consider two identical counter top manufacturers as illustrated in Table One. Manufacturer A continues with the status quo. Manufacturer A has $1 million of profit annually and pays taxes of $500,000 per year. At the end of ten years, Manufacturer A has accumulated $5.9 million based on a reasonable investment return. Manufacturer B, however, implements ERM and owns a CIC. In the exact same 10 year period, Manufacturer B has MORE INSURANCE and MORE MONEY (almost twice as much wealth as A).

One of the primary objectives of any insurance company is to build up significant reserves for the future. And, insurance companies enjoy many tax advantages as they accumulate reserves. Captive insurance companies are no different. When a business owner sets up a captive insurance company to formally insure risk, he or she also benefits by being able to accumulate wealth in a more tax efficient vehicle.

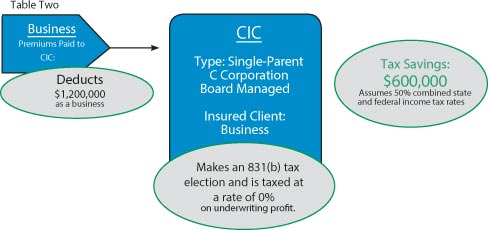

The operating company (or parent company) pays tax deductible premiums to the captive insurance company. And, small captive insurance companies may make an 831 (b) tax election. As such, they are taxed at zero percent (0%) on their underwriting profit. Underwriting profit is simply defined as premiums collected less claims paid.

Small insurance companies by definition receive $1.2 million or less in annual premiums according to the Internal Revenue Code (IRC). The result is a remarkably efficient vehicle to accumulate loss reserves (and by extension wealth) for the future. This prevents the counter top manufacturer and its owners from being hollowed out by excessive taxation.

In Table Two, the countertop manufacturer pays $1.2 million to purchase insurance from its captive insurance company. The captive insurance company (which is owned by the business owner(s)) makes and 831(b) tax election and is taxed at a rate of 0% (zero percent). This results in $600,000 of tax savings. This helps ensure the business is NOT hollowed out by taxation and can weather uncertainty.

In Table Two, the countertop manufacturer pays $1.2 million to purchase insurance from its captive insurance company. The captive insurance company (which is owned by the business owner(s)) makes and 831(b) tax election and is taxed at a rate of 0% (zero percent). This results in $600,000 of tax savings. This helps ensure the business is NOT hollowed out by taxation and can weather uncertainty.

What Is A Captive Insurance Company?

A captive is a unique insurance company. It includes its own corporation, insurance license, reserves, policies, policyholders, and claims. It is a formal way for business owners to self-insure risk, and captives are generally formed to insure primarily though not exclusively the risks of one or more businesses owned by the same or related parties.

How Does a Captive Insurance Company Work?

A captive primarily insures its parent company or related companies. It typically forms the backbone of a company’s Enterprise Risk Management (ERM) strategy. Hence, the parent company is able to purchase insurance from its captive, and it can insure risks that third party insurers will not insure or risks where third party insurance cost is not affordable. The captive can also insure the gaps in third party commercial insurance policies. Premiums are paid from the parent (operating) company to the captive with pre-tax dollars. The captive can invest its assets mostly as its owners choose (some domiciles have restrictions).

Time For A Better Model?

It may be time for your business to implement ERM and for you to own your own insurance company. If the thought of having both more insurance and more money sounds like the right move for you, feel free to call me at 865-599-6104 or send e-mail to randy@cicservicesllc.com .