How to Turn Risk Management Into a True Profit Center for Your Shop

Randy Sadler

Principal, CIC Services LLC

Here is a captivating question. How can a countertop manufacturer turn its risk management into a true profit center?

It sounds impossible – turning risk management into a profit center? Risk management pays insurance premiums and operates safety programs. How could it possibly be a profit center?

Furthermore, this is not simply a question about cost containment or even cost reduction. To succeed, the manufacturer’s risk management strategy must give the owners access to more money than they would have had otherwise, including completely offsetting the cost of commercial insurance and loss control programs. Clearly, a question this challenging requires some captivating thinking.

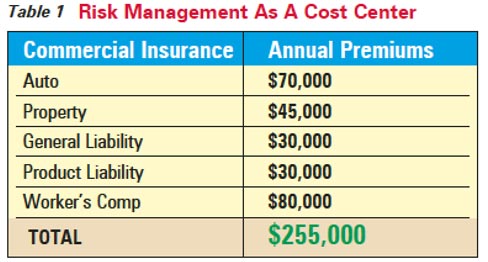

Consider this case study of a countertop manufacturer. The captivating risk management approach I will outline could apply to many sizes of profitable manufacturers in a variety of circumstances. As Table 1 below illustrates, risk management is a cost center, and the company pays $255,000 in annual commercial insurance premiums.

Consider this case study of a countertop manufacturer. The captivating risk management approach I will outline could apply to many sizes of profitable manufacturers in a variety of circumstances. As Table 1 below illustrates, risk management is a cost center, and the company pays $255,000 in annual commercial insurance premiums.

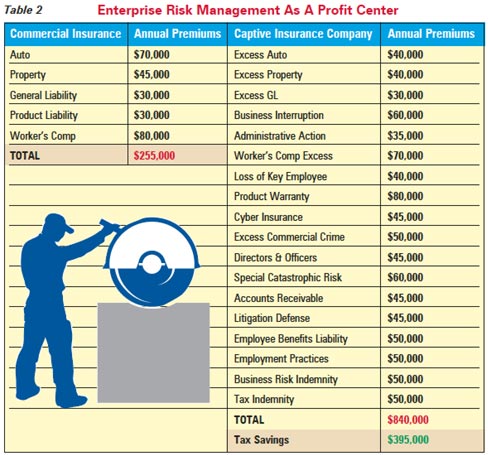

It’s time for some captivating thinking. Table 2 compares the exact same manufacturer with an Enterprise Risk Management (ERM) strategy in place. ERM is a discipline whereby a business assesses all the threats it faces and develops a comprehensive risk management plan.

As part of its ERM approach, the countertop fabricator implements steps to reduce risk and mitigate risk. Keep in mind that insurance is a financial risk mitigation approach. As part of its ERM strategy the owner or owners set up, operate and own their own insurance company, known as a captive insurance company (CIC). The CIC forms the backbone of the ERM strategy. The CIC significantly increases the company’s insurance coverage, addressing many of the risks identified in the comprehensive risk assessment.

The CIC is owned directly by the company’s owners. So the owners and the company effectively retain the profits in the captive insurance company. Because this CIC takes in annual premiums of less than $1.2 million, it can make an 831(b) tax election and be taxed at a rate of zero percent (0%) on its underwriting profit. In the next illustration, this results in $395,000 in annual tax savings. This assumes a combined federal and state tax rate of 47%.

Table 2 illustrates how ERM with a CIC turns risk management into a true profit center that – in effect – pays the owners or increases the total wealth of the owners. The ERM Program results in $395,000 in tax savings. The tax savings generates an estimated $11,850 in investment income (assumes 5 percent return and 3 percent after tax return). The CIC pays $65,000 to operate, renew its actuarial pricing of policies, issue policies, renew its insurance license, conduct an annual audit and purchase reinsurance for its policies. As we have already established, the countertop manufacturer spends $255,000 on commercial insurance. As part of its ERM strategy, the company is now able to invest $20,000 in loss control and safety programs.

Table 2 illustrates how ERM with a CIC turns risk management into a true profit center that – in effect – pays the owners or increases the total wealth of the owners. The ERM Program results in $395,000 in tax savings. The tax savings generates an estimated $11,850 in investment income (assumes 5 percent return and 3 percent after tax return). The CIC pays $65,000 to operate, renew its actuarial pricing of policies, issue policies, renew its insurance license, conduct an annual audit and purchase reinsurance for its policies. As we have already established, the countertop manufacturer spends $255,000 on commercial insurance. As part of its ERM strategy, the company is now able to invest $20,000 in loss control and safety programs.

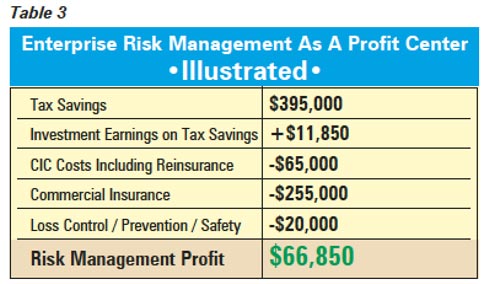

As can be seen in Table 3, ERM with a CIC produces a dramatic result. This company’s risk management strategy was a drain on the business, costing it $255,000 annually. With ERM in place, the risk management program created $66,850 incremental wealth to the owners after offsetting: the cost to operate the CIC, the cost to reinsure the CIC, the total cost of commercial insurance, and the cost of implementing a loss control program. This is a $321,850 positive swing (from spending $255,000 annually to saving $66,850 annually). Captivating Thinking enables successful owners to convert risk management from a cost center into a powerful profit center.

What Is a Captive Insurance Company?

What Is a Captive Insurance Company?

Simply put, businesses or their owners can choose to OWN THEIR OWN INSURANCE COMPANY. A captive insurance company is a licensed insurance company. Captives are formed to provide insurance protection to businesses and related entities. They aren’t licensed to sell insurance to the general public. They are usually owned by the business, the business owners, a holding company or other related parties. Businesses pay premiums as an ordinary business expense to their captive insurance company(ies). The captive issues insurance policies to the company. Captive policies are priced by an actuary and often verified by the domicile regulator. When the business files an insured claim, the captive pays it. Like commercial insurance companies, captives also accumulate loss reserves. Reserves can be invested in accordance with the captive’s Investment Policy Statement (IPS). The IPS is approved by the domicile. Captives can replace commercial insurance coverage or leave commercial coverage intact and insure other risks the business faces for which it is currently not purchasing third party insurance.

What Is an 831(b) Tax Election?

What Is an 831(b) Tax Election?

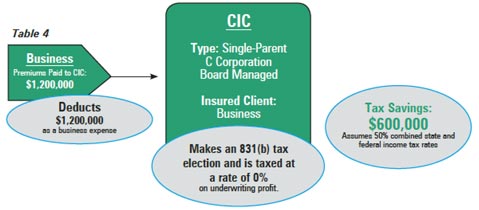

Small captive insurance companies may make an 831(b) tax election. “Small” captives are defined as having underwriting profits of less than $1.2 million annually. In 2017, this limit increases to $2.2 million. Underwriting profit is simply calculated as premiums received less claims paid. Captives making an 831(b) election are taxed at a rate of 0% (zero percent) on their underwriting profits. Table 4 shows a business that pays premiums of $1.2 million to its small captive insurance company. Its captive makes an 831(b) tax election, and is taxed at a rate of zero percent. In this illustration, the resulting annual tax savings is $600,000.

How Can ERM and Small Captives Turn Risk Management into a True Profit Center?

Captives are a powerful financial vehicle that resolves a contradiction that most business owners and their advisors face. In business and in our human relationships, we usually expect to have to give up something to get something. For a business to enjoy more insurance protection and greater risk management flexibility, one would expect to have less money. In this regard, a captive insurance company can be a real game changer, enabling a business or business owner to have more insurance protection, greater flexibility and more money.

Randy Sadler is an entrepreneurial leader with a proven track record in alternative risk management, real estate, sales and marketing. He joined CIC Services, LLC as a Principal and Director of Marketing in 2012. He has been a real estate investor and property manager for 24 years, and his partnerships manage over 400 residential properties. His real estate experience formed a natural bridge for him to serve as a Principal in a captive insurance company management firm, as captives and real estate have many parallel benefits including tax savings and wealth accumulation.

For more information on ERM for small and mid-sized businesses, visit www.captivatingthinking.com or contact the author at randy@cicservicesllc.com .